Navigating the 2024 Tax Landscape

Tax season can be daunting, especially with changes to tax laws. The 2024 tax brackets represent a significant aspect of this landscape. Understanding these brackets is paramount to accurately calculating your tax liability and avoiding costly mistakes. This article will provide a clear and concise overview of the updated 2024 rates, explaining how they affect different income levels. We'll also touch upon some key considerations to keep in mind as you prepare your return.

Understanding the 2024 Tax Bracket System

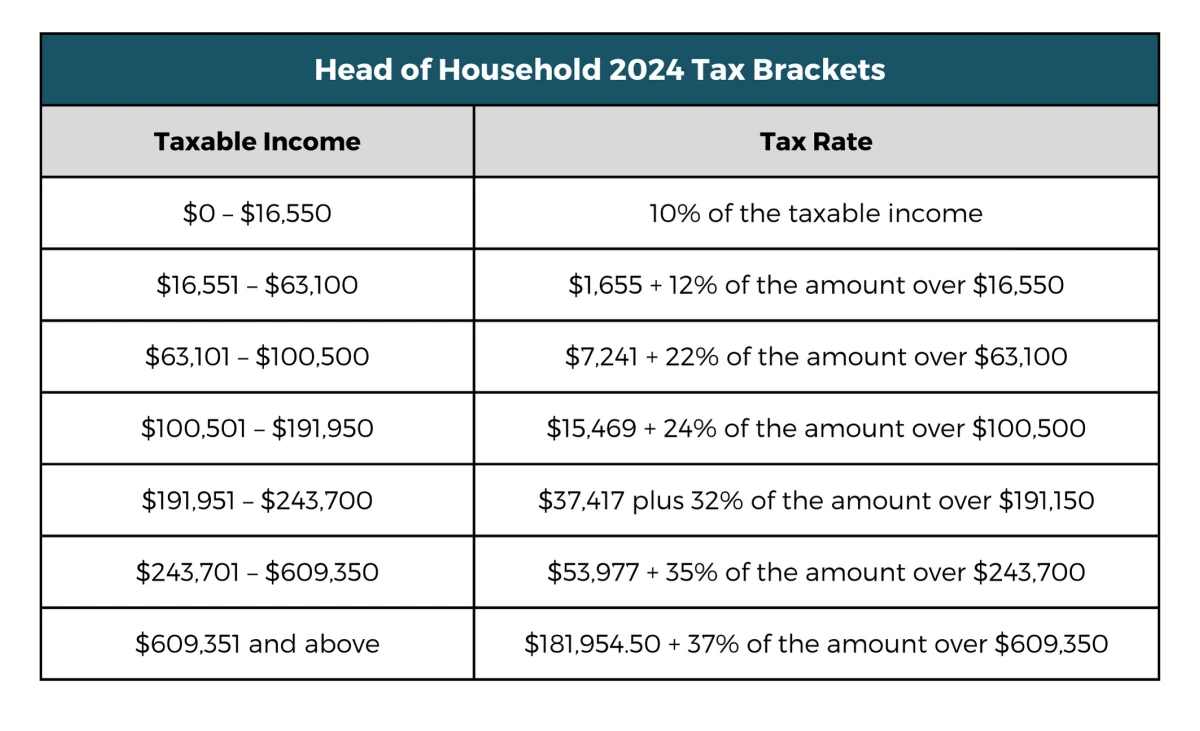

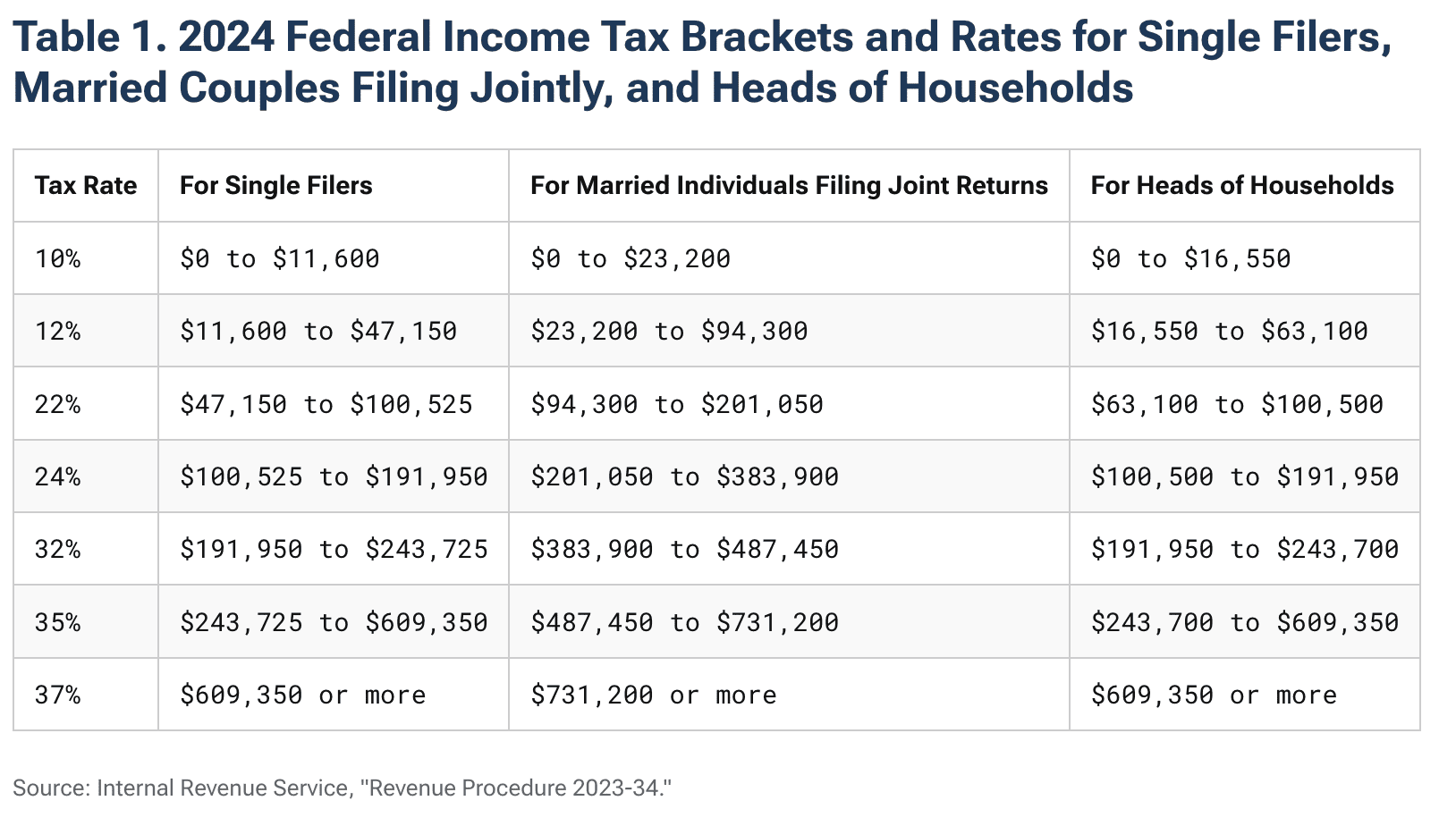

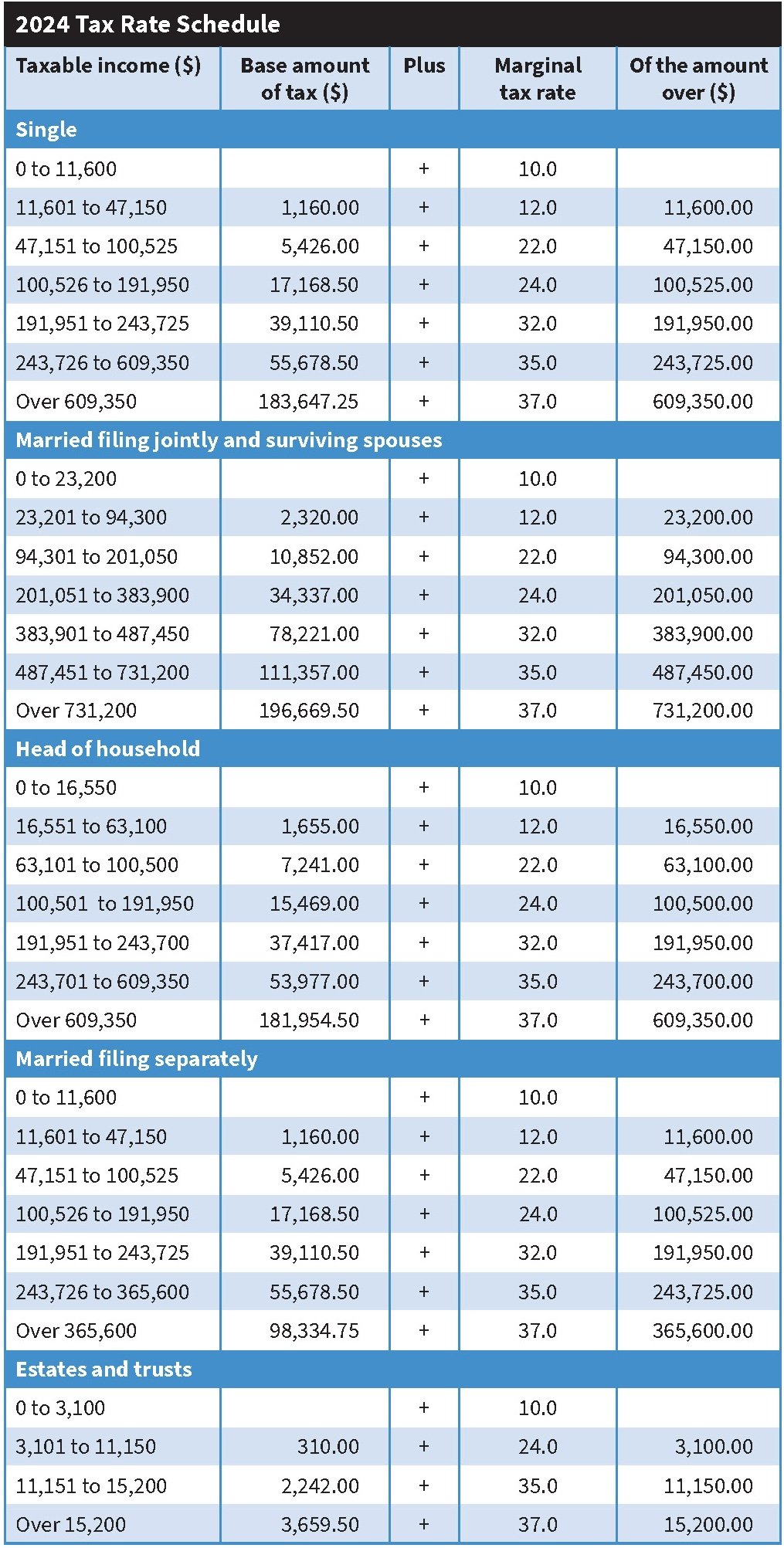

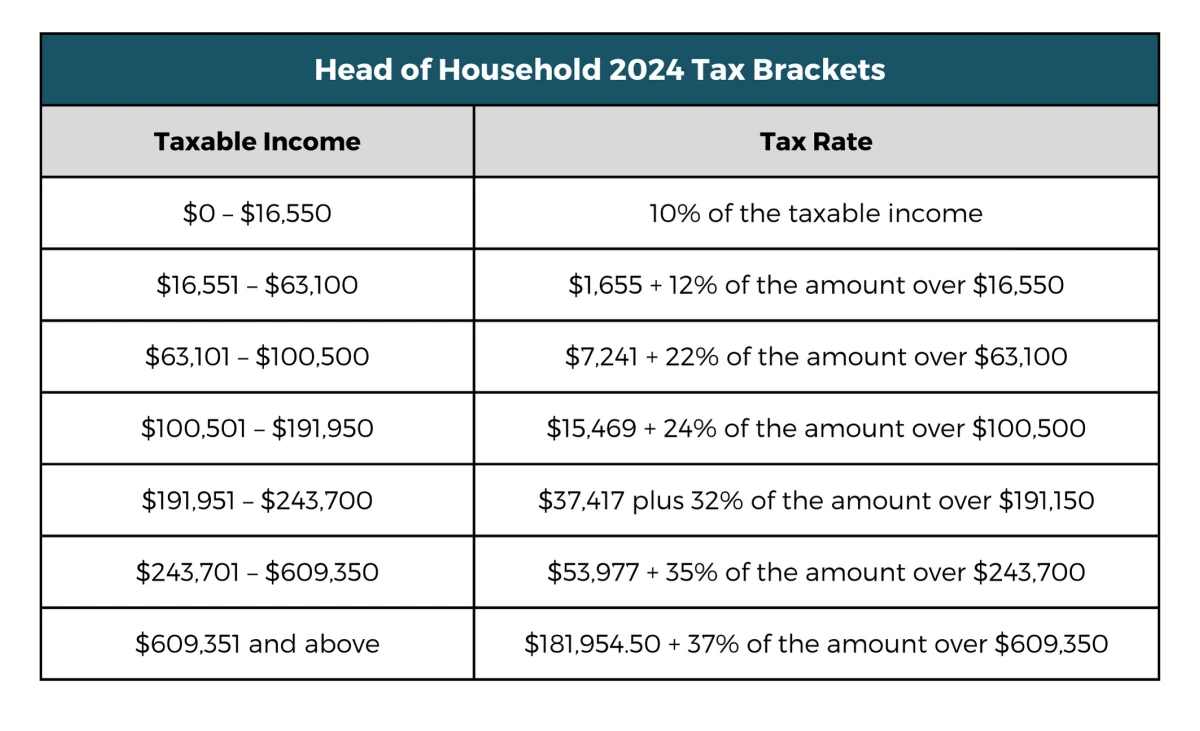

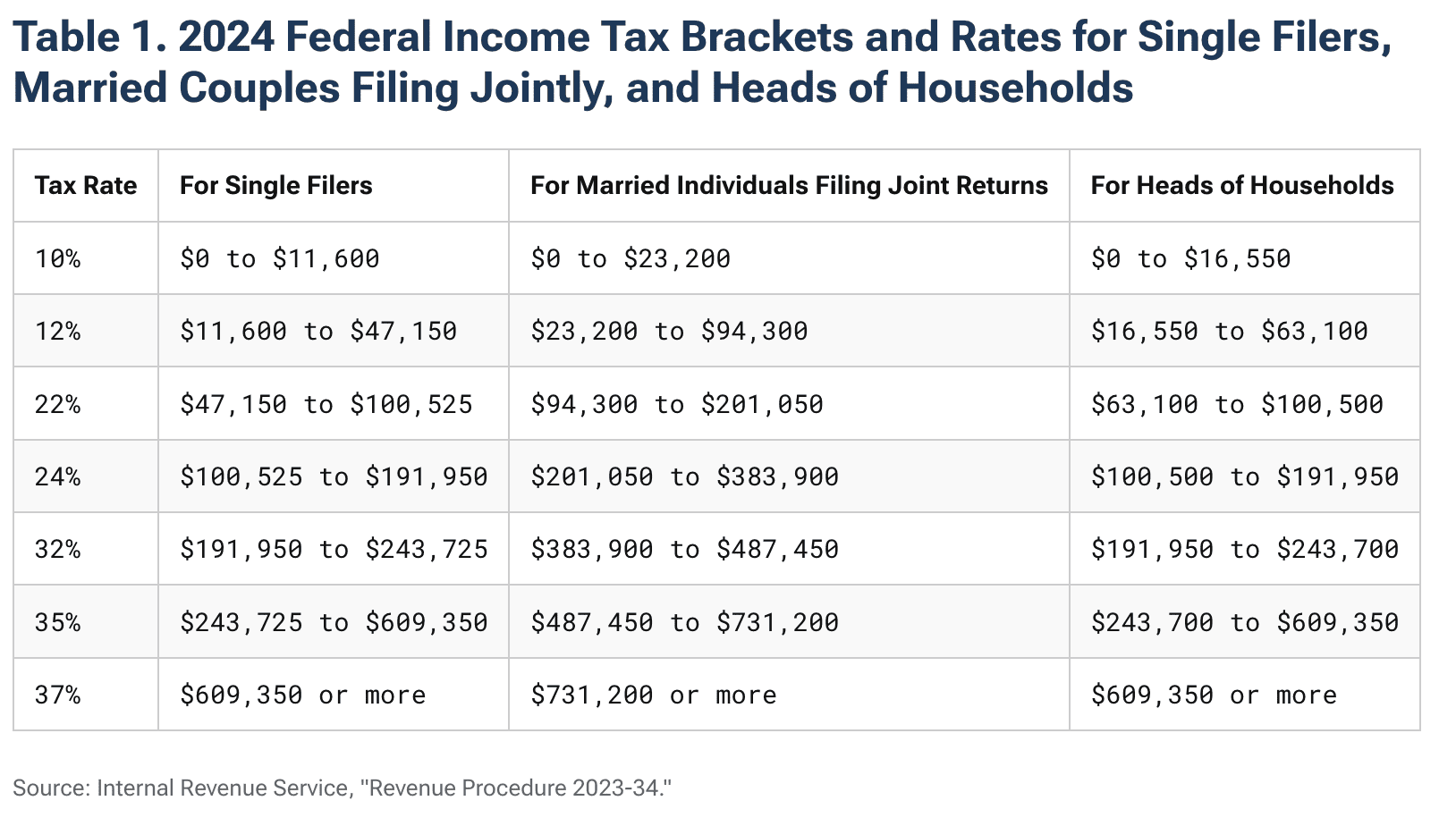

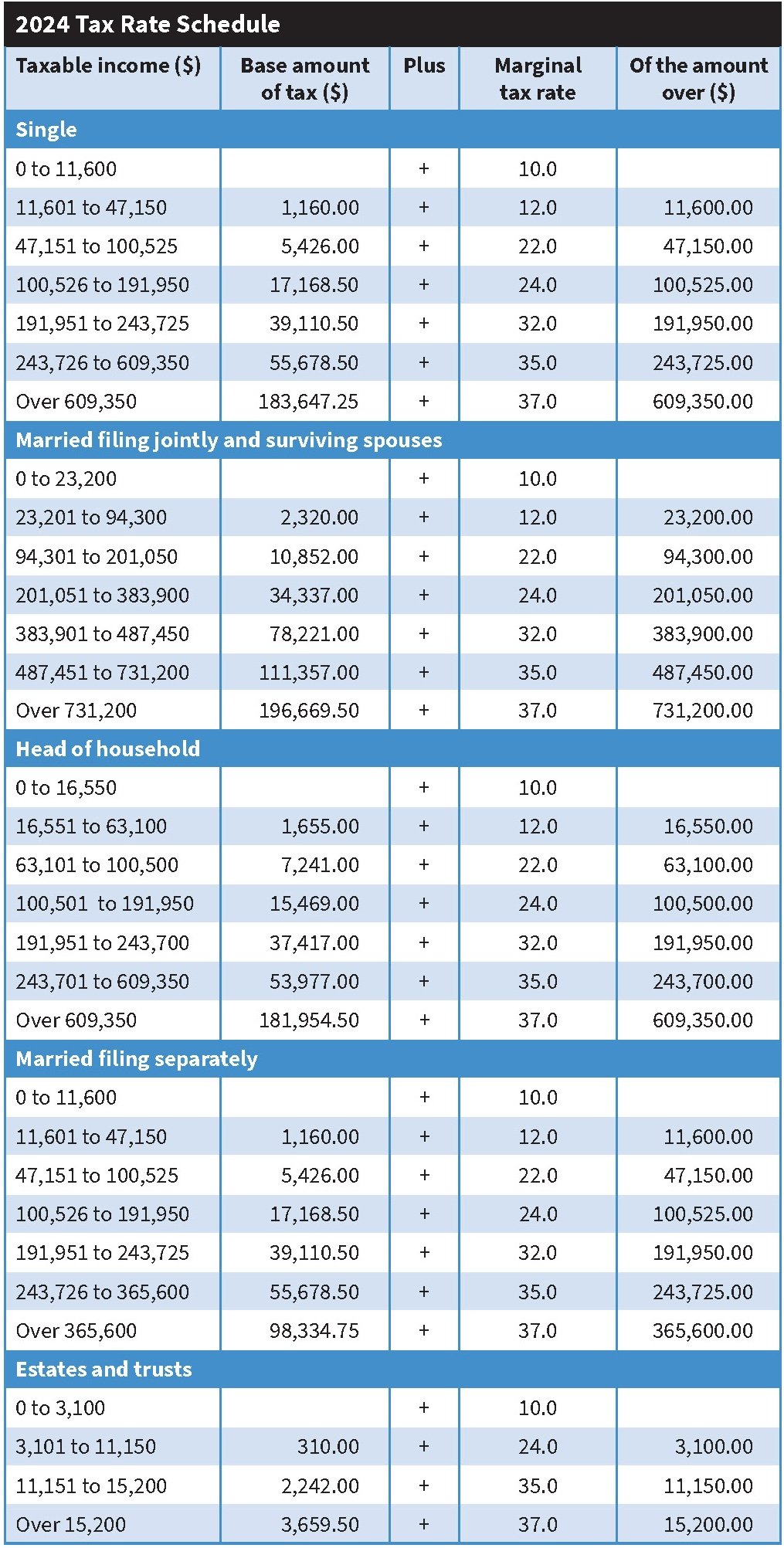

The 2024 tax brackets are designed as a progressive system, meaning higher earners pay a larger percentage of their income in taxes. This system is structured into various income ranges, each associated with a specific tax rate. The more you earn, the higher the tax bracket you fall into, leading to a higher overall tax bill. It's important to remember that the tax rate applied to your income is dependent on the bracket your income falls within, not your entire income. For example, you may earn income in multiple brackets, but you only pay the higher bracket rate on the income exceeding that specific threshold.

Key Changes in the 2024 Tax Brackets

While the exact figures are subject to government confirmation before the tax year begins, understanding the potential shifts in the 2024 tax brackets is vital for planning. Proposed changes may involve adjustments to the income thresholds defining each bracket, as well as possible modifications to the tax rates themselves. Staying updated on these potential alterations is crucial for avoiding surprises come tax time. Consult official government sources for the most up-to-date and accurate information.

Analyzing Your Tax Situation

Once you understand the 2024 tax brackets, you can start analyzing your personal tax situation. Consider your various income streams, deductions, and credits to determine your overall tax liability. Tax software or professional tax advice can be beneficial in navigating the complexities of the tax code and ensuring accurate calculations. Remember, planning ahead can greatly minimize potential stress during tax season.

Tax Planning Strategies for 2024

Effective tax planning involves proactive strategies to minimize your tax burden within legal boundaries. This might involve adjusting your withholdings from your paycheck, maximizing tax deductions, or contributing to tax-advantaged retirement accounts. By understanding how the 2024 tax brackets impact your income, you can make informed decisions that optimize your tax situation. Seek advice from a qualified tax professional if you have complex financial situations.

Staying Informed and Prepared

The tax system is constantly evolving, and it is essential to remain updated on any changes. Staying informed allows for effective tax planning and avoidance of unexpected tax liabilities. Utilize reputable financial websites and official government resources to ensure you have access to the most current information regarding the 2024 tax brackets and other tax-related matters. Proactive planning and consistent updates will help you navigate tax season with confidence.

0 Comments