Navigating the 2024 Tax Landscape

Tax season can be a daunting experience, but understanding the 2024 tax brackets is the first step to a smoother process. The Internal Revenue Service (IRS) annually adjusts these brackets to account for inflation, meaning the thresholds for each tax rate change. This year's adjustments have significant implications for taxpayers, impacting how much you ultimately owe or, potentially, receive as a refund. Staying informed about these changes ensures you’re prepared and can plan your finances accordingly. This article will dissect the key changes and provide you with the information you need to navigate the 2024 tax brackets with confidence.

Key Changes in the 2024 Tax Brackets

While the exact figures will be released closer to tax season, preliminary information suggests several key changes to the 2024 tax brackets. These alterations often revolve around adjusting the income thresholds for each tax rate. A higher inflation rate typically translates to higher bracket thresholds, meaning more individuals could potentially fall into lower tax brackets. However, it's crucial to remember that even with adjusted brackets, your overall tax liability depends on various deductions and credits you may be eligible for. Understanding these nuances is vital for accurate tax preparation.

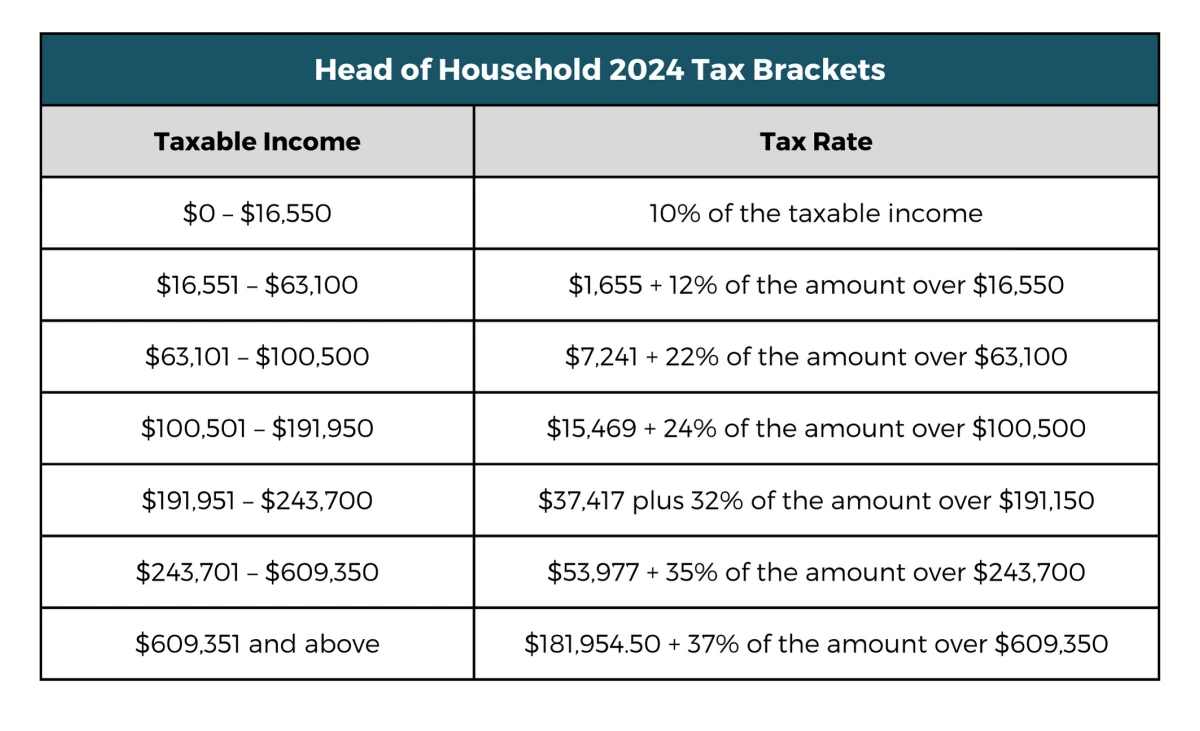

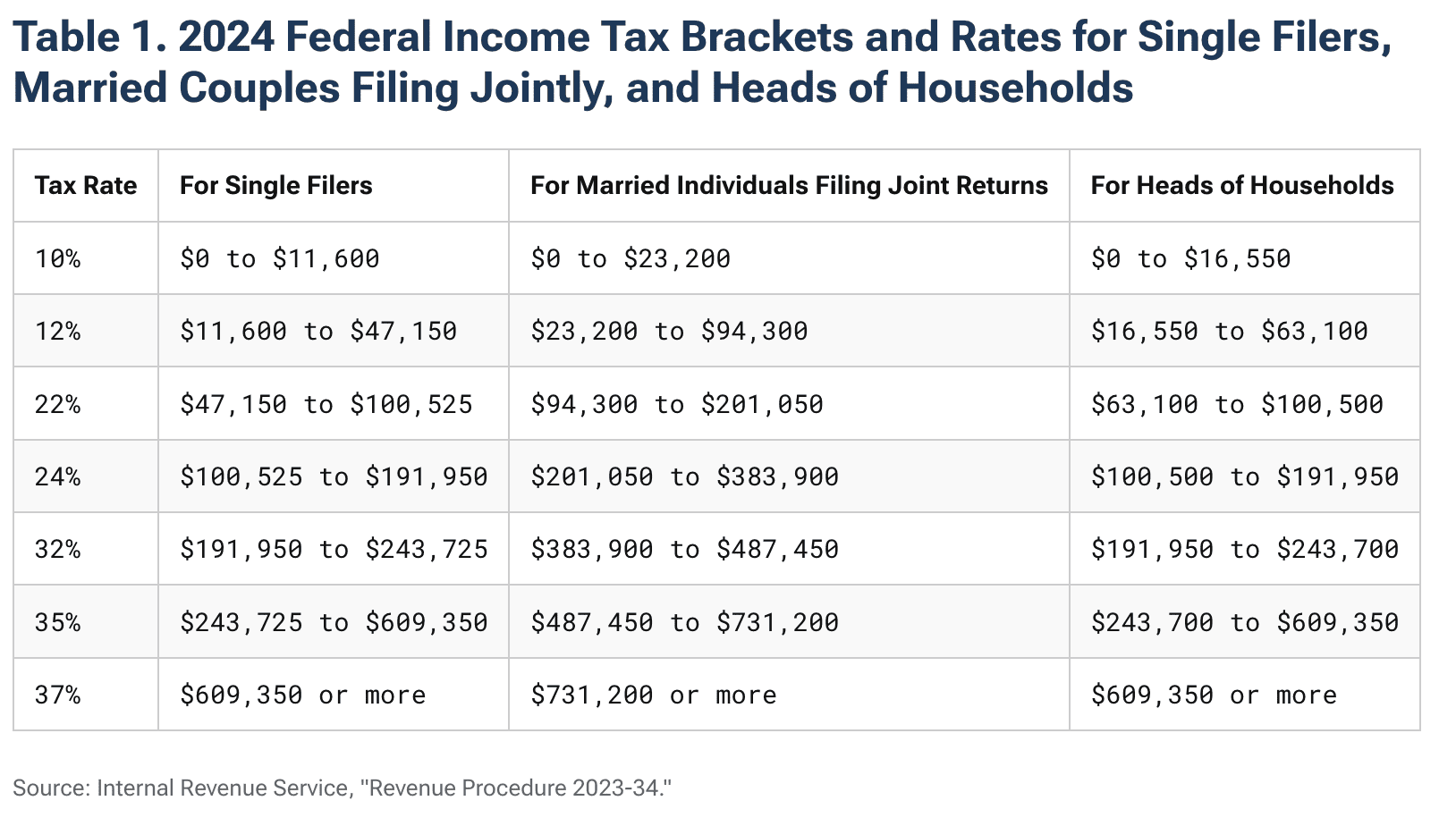

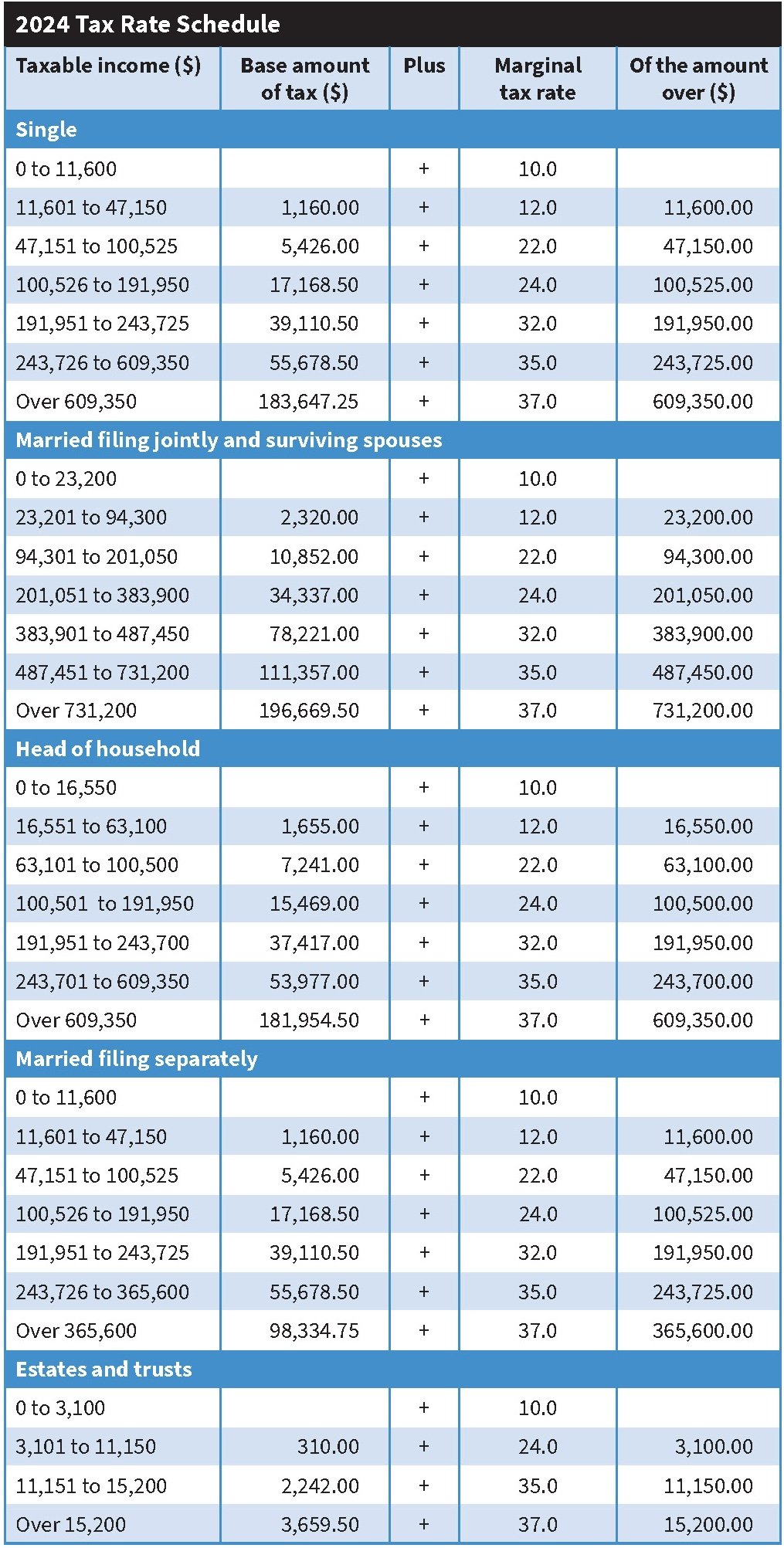

Understanding Tax Rate Structures

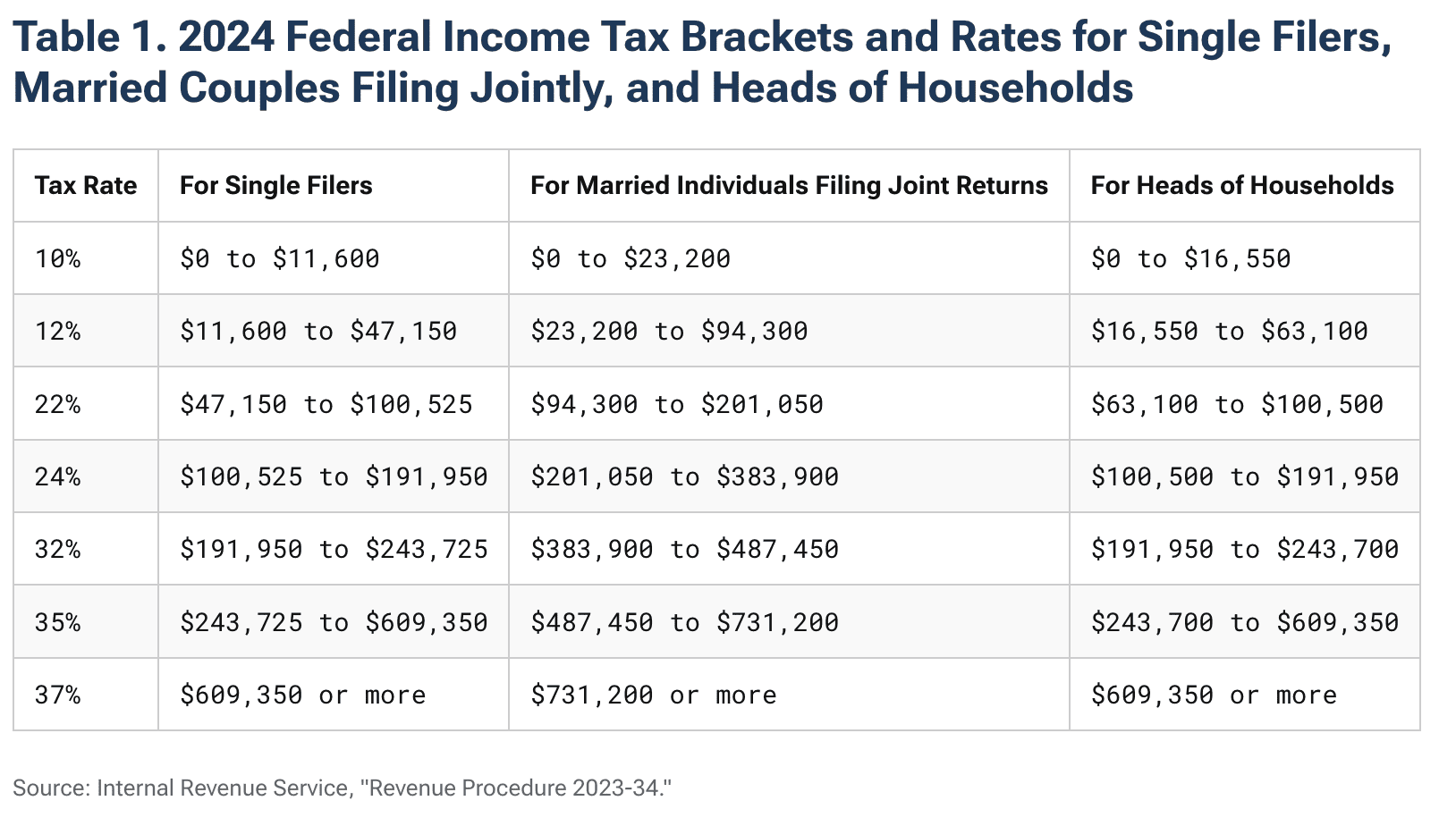

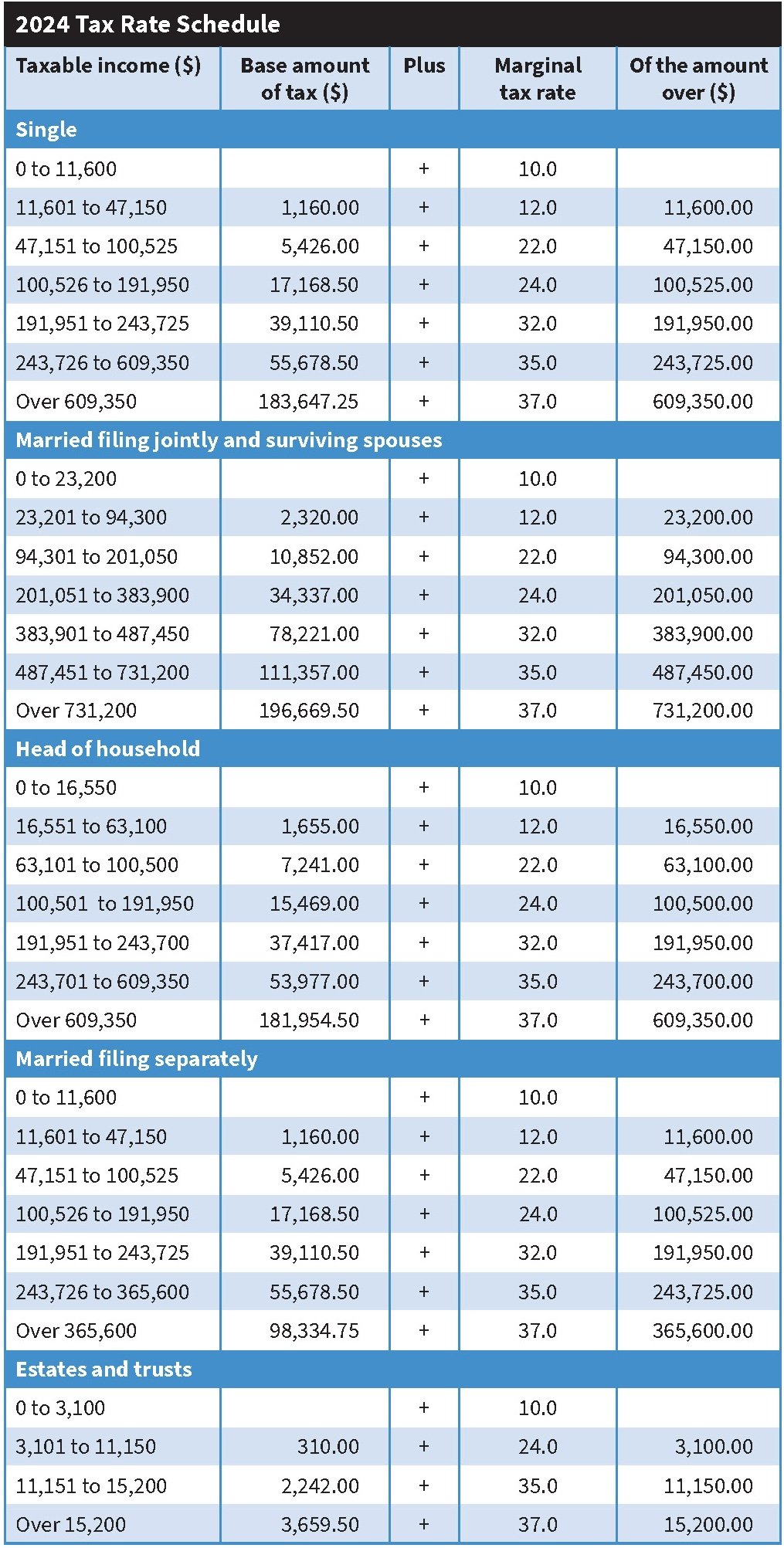

The 2024 tax brackets utilize a progressive tax system, meaning higher income earners face higher tax rates. Each bracket represents a specific income range, with each range taxed at a corresponding rate. It's important to note that this isn't a simple calculation of your total income multiplied by the highest bracket's rate. Instead, only the portion of your income falling within each bracket is taxed at that particular rate. This progressive structure is designed to ensure a fairer distribution of the tax burden across different income levels. For example, only the income exceeding the threshold for a specific bracket will be taxed at that bracket's higher rate. The rest will be taxed according to the lower bracket rate.

How to Prepare for Filing Your 2024 Taxes

Gathering all necessary documentation is paramount. This includes W-2 forms, 1099 forms, and any other relevant tax documents. Review your tax returns from previous years to identify any potential deductions or credits you may be eligible for. Utilize available IRS resources, including their website and publications, to enhance your understanding of the intricacies of the 2024 tax brackets and relevant tax laws. Consulting with a tax professional can be invaluable, especially if you have a complex financial situation or are unsure about specific aspects of your tax obligations.

Tax Planning Strategies for 2024

Proactive tax planning is essential, particularly given the shifts in the 2024 tax brackets. Review your income projections for the year and consider adjusting your withholdings to avoid a large tax bill at the end of the year or a significant refund. Explore available tax-advantaged savings and investment options to reduce your taxable income. Familiarize yourself with tax credits and deductions that might apply to your circumstances, as these can significantly decrease your overall tax liability. Making informed decisions now can potentially save you money in the long run.

Stay Updated on Tax Law Changes

Tax laws are subject to change, so staying informed is crucial. The IRS website is an excellent resource for the latest updates and official guidance. Subscribe to reputable financial news outlets and tax publications to receive timely updates on any adjustments or clarifications regarding the 2024 tax brackets and other relevant tax regulations. By keeping abreast of these changes, you can make the most informed decisions concerning your tax planning and filing. Being proactive and well-informed ensures you are navigating the tax landscape efficiently and effectively.

0 Comments